Understanding the credit score required for emergency loans in the US is crucial for anyone considering this financial option. The eligibility criteria for borrowing depend significantly on one’s credit rating. Knowing how it influences loan approval can help borrowers make informed decisions during urgent situations.

This article will explore this financial mechanism and guide you through interpreting your credit score. Whether you’re facing unexpected medical expenses or urgent car repairs, deciphering your creditworthiness in relation to loans is instrumental. Let’s delve into the nuances of credit scores and their impact on your ability to secure emergency funds.

Understanding credit score implications

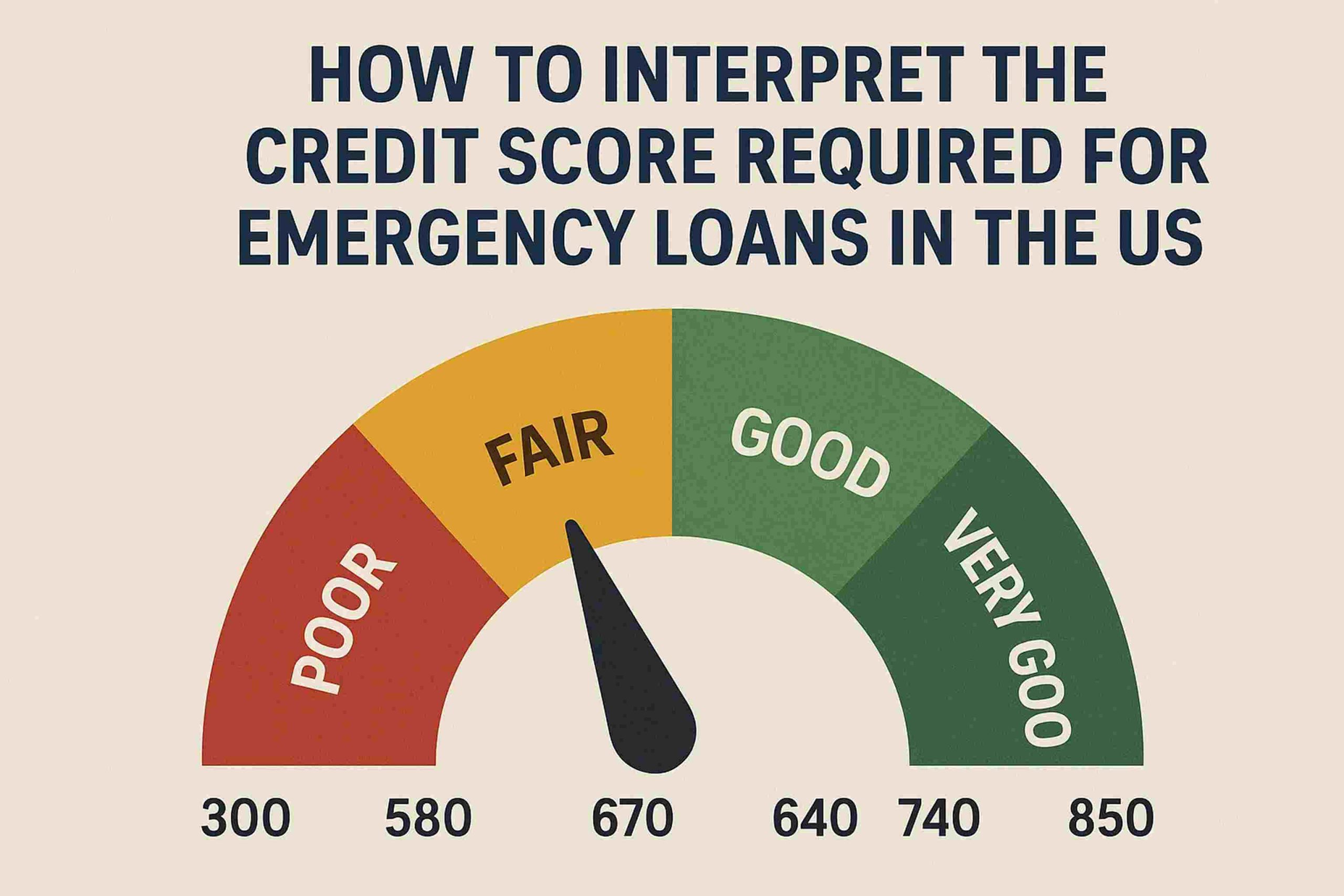

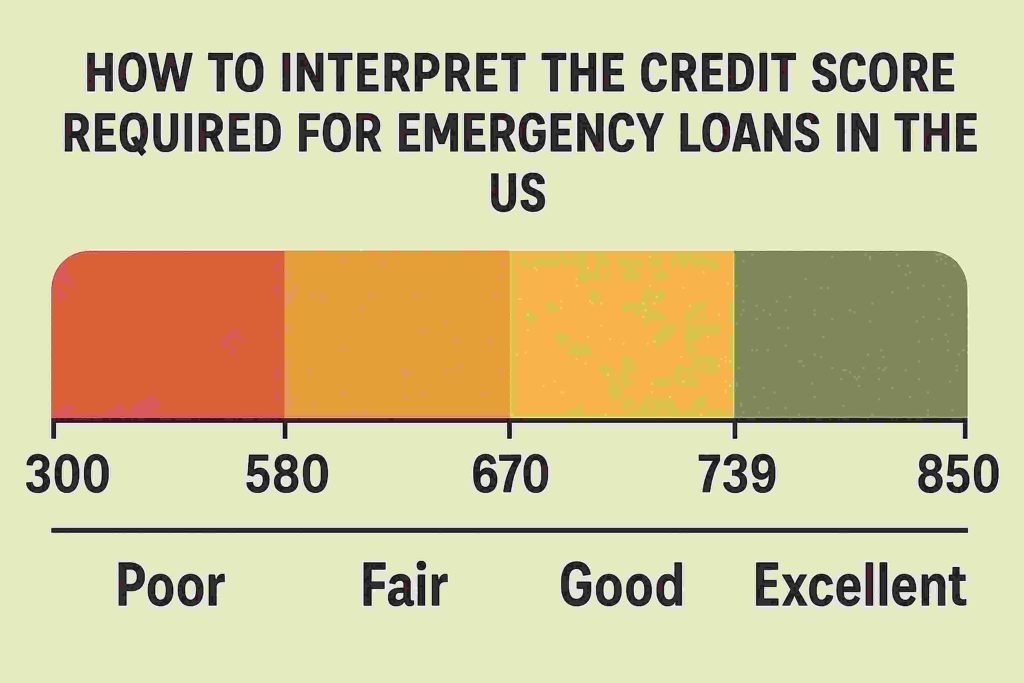

Your credit score plays a pivotal role in determining your eligibility for a loan. It’s a number that reflects your creditworthiness and, ultimately, the likelihood of repaying borrowed funds. Typically, scores range from 300 to 850, with higher values indicating greater reliability as a borrower.

Lenders analyze these scores to assess the risk involved in granting you financial support. While a high credit score is advantageous, emergency loans may still be available for those with lower scores, albeit at higher interest rates. Understanding these score ranges and their effects is vital.

The significance of different credit score ranges

Different credit score brackets impact your loan terms distinctly. Generally, scores above 700 are considered good or excellent, making it easier to secure a loan with favorable terms. Scores between 600 and 699 mark the average range, where borrowers might still access loans, but possibly at less competitive terms.

For those with scores below 600, options are typically limited to loans with higher interest rates and more stringent repayment terms. Recognizing where you stand can provide a realistic viewpoint on the types of emergency loans you might qualify for, helping you prepare accordingly.

Factors affecting credit score in loan applications

Several elements can influence your credit score, thereby affecting loan approval. Payment history, credit utilization, length of credit history, new credit inquiries, and credit mix all contribute to your score. Maintaining a healthy combination of these factors can improve your credit profile.

Understanding the weight of each factor aids in managing your credit score effectively. For instance, consistently paying bills on time constitutes a significant portion of your score. By focusing on improving these areas, you increase your chances of securing a more favorable loan agreement.

Practical tips to enhance your credit profile

Improving your credit score is often a strategic process. Begin by reviewing your credit report for inaccuracies and disputing any errors. Establish routines for timely payments to enhance your payment history, which is a crucial factor in your score.

Lowering your credit card balances can also improve your credit utilization ratio, another critical component. Diversifying your credit mix, such as adding a different type of credit account responsibly, can positively affect your score over time. These actionable steps can position you better when seeking emergency loans.

Conclusion: navigating the credit score landscape

Interpreting your credit score in the context of emergency loans can significantly affect your financial decisions. Armed with this knowledge, you can better navigate your options and select the most advantageous loan terms available to your credit profile.

Understanding the interplay of credit scores and loan terms equips you to face financial challenges with greater confidence. By proactively managing your credit profile, you enhance your readiness for emergencies and remain poised for securing necessary funds when time is of the essence.