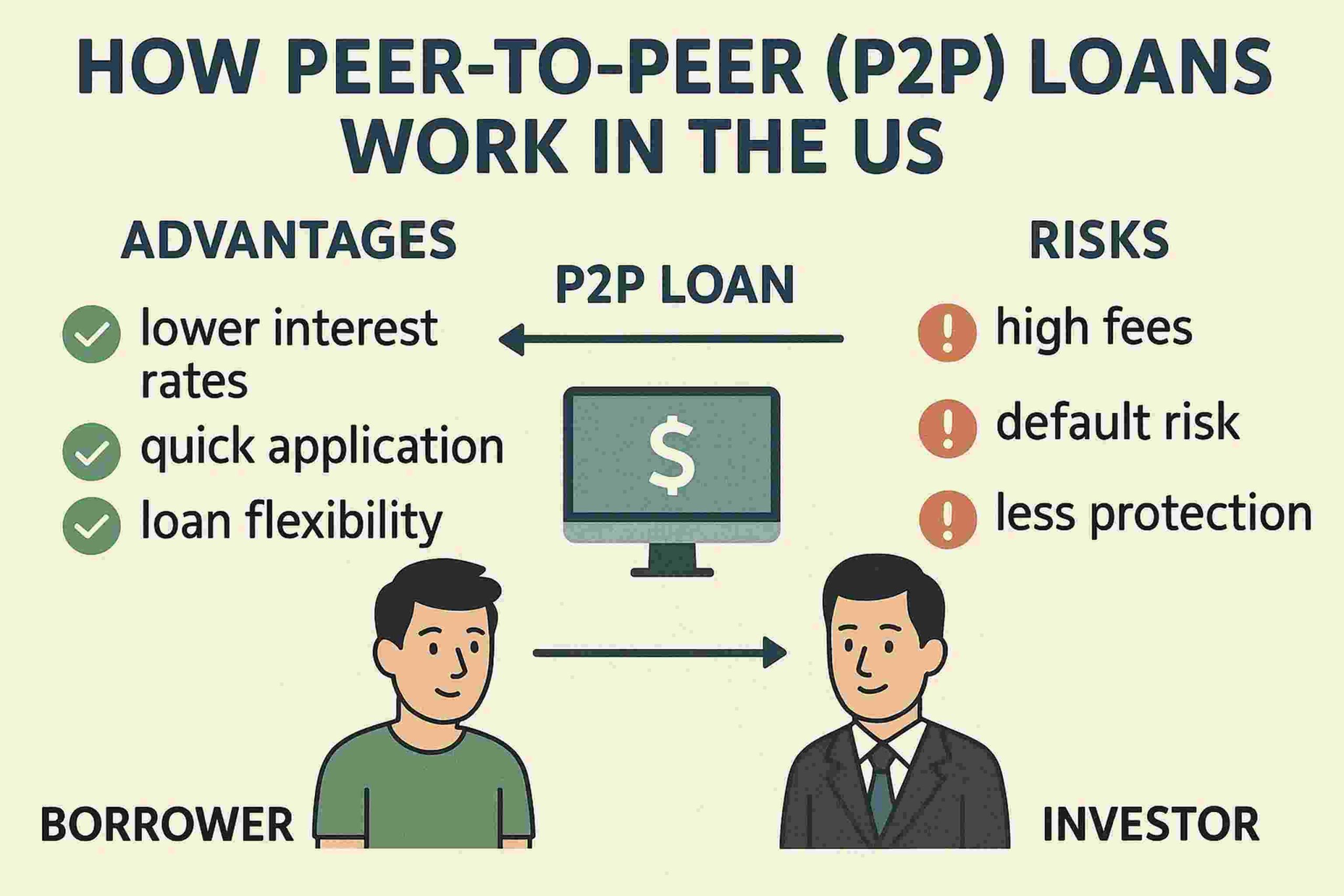

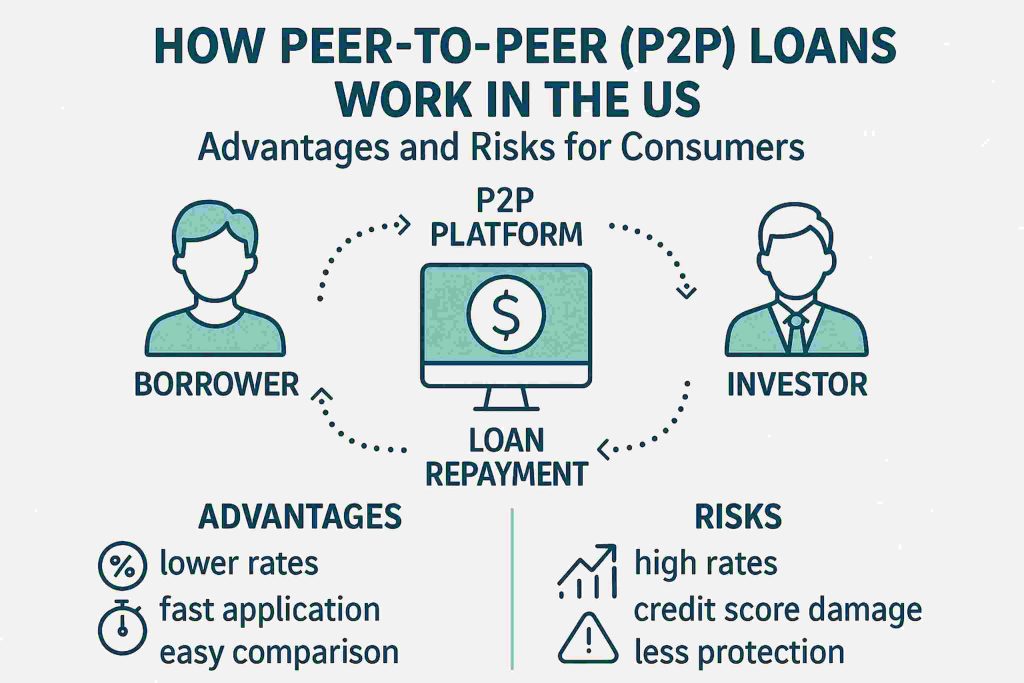

Peer-to-peer (P2P) lending has become a popular loan option in the US, providing a modern alternative to traditional bank lending. This innovative system connects borrowers directly with investors through online platforms, making it easier for individuals to secure needed funds without going through banks.

This method often results in lower interest rates for borrowers and more favorable terms for investors, making it an attractive option for both parties. Understanding how P2P lending functions, as well as its benefits and drawbacks, is essential for anyone considering this financing route.

Understanding P2P lending

P2P lending is a system where individuals can obtain a loan from other people, bypassing conventional banks. This approach, facilitated by internet platforms, has gained traction due to its efficiency and accessibility. Borrowers can submit loan applications through dedicated P2P platforms, which connect them with potential investors willing to fund their needs.

Investors analyze loan requests, and if interested, fund the loans with the expectation of receiving returns from future interest payments. This process democratizes lending by allowing virtually anyone to participate, either as a borrower or an investor.

The advantages for borrowers

For those seeking loans, P2P lending offers numerous benefits. One major advantage is potentially lower interest rates compared to traditional financial institutions, as the cost of intermediary services is reduced. Additionally, the application process is often simpler and faster, aiding borrowers who need quick financial solutions.

Furthermore, individuals with suboptimal credit scores might still have the chance to secure funds, depending on the platform’s criteria and investor willingness. This creates a more inclusive environment for a diverse range of applicants seeking financial assistance.

Weighing the risks

While P2P lending presents many advantages, it also involves certain risks. For borrowers, one primary concern is that failing to meet repayment obligations can lead to negative credit reporting, affecting future borrowing capabilities. Meanwhile, investors face the risk of borrower defaults, potentially leading to financial losses.

As most P2P platforms do not offer formal guarantees, investors must carefully assess loan applications. Additionally, borrowers should be aware of potential high fees and penalties that some platforms may charge, which can impact the overall cost of the loan.

Practical tips for safe lending

Both borrowers and investors can take steps to mitigate risks in P2P transactions. Borrowers should research and choose reputable platforms that have transparent terms and solid reputations. Reading user reviews and comparing interest rates can help in making informed decisions.

Investors, on the other hand, should diversify their contributions across multiple loans to spread risk and utilize the platform’s data analytics tools to assess borrower creditworthiness. By staying informed and cautious, participants in P2P lending can maximize the benefits while minimizing potential downsides.

Conclusion of the P2P lending landscape

Peer-to-peer lending represents a significant evolution in the way loans are processed and accessed in the US. It offers an appealing option for those looking to cut down on banking bureaucracy and secure personalized loan terms. However, the landscape is not without challenges, and both borrowers and investors must remain vigilant.

By understanding the system’s dynamics and weighing the pros and cons, participants can make informed financial decisions that align with their needs and risk tolerance. As P2P lending continues to grow, it will likely play an increasingly significant role in the financial ecosystem.